Looking to Buy?

The first step is coming in for a one-on-one meeting, But to get you prepped, here’s a handy guide on how home buying in NYC works:

What are the benefits of buying?

There’s a reason home ownership is a cornerstone of the American dream. On top of the stability and independence that come along with owning your space, the tax deductions, return on equity at sale, and appreciation make it a possible income producer as well as a home. Add this to low interest rates, the unseen costs of renting, and the potential for “waking up money” from real estate investments in the future, and it’s no wonder so many people want to buy. Always talk to a financial professional about your personal situation but familiarize yourself with some of the upsides at the links below. Related posts:

Why should I work with an agent?

First of all, it’s usually free; sellers pay the commission for their agents and buyers’ agents. Not working with someone is like representing yourself in court when given a free attorney, except in this case you can even CHOOSE the person. And for the most financially and emotionally significant purchase of your life, teaming up with a professional (or really, a group of professionals) is always better than going it alone. Still unconvinced, or want more details? Scope the posts below for more info on what the buying process entails and what a good agent can do for you. Related posts:

What Can i buy and how?

There are four main types of property in NYC: standalone buildings, condos, co-ops, and condops. Each one has a basic set of characteristics, but every building is different, which is part of what makes buying so interesting but also overwhelming. The process is slightly different for each one, but it begins with coming in for a one-on-one meeting with your potential agent. Choose someone you communicate well with and trust; you’ll be spending a lot of time together during an emotional and high-stakes purchase. You really need a set of professionals to guide you through, but checking out the buyers’ guide at the top of the page plus reading the links below will give you some insight. Related posts:

How much money do I need to buy something?

This depends on property type, price point, whether it’s new development, etc. But generally, a down payment will be at least 10% (condo or standalone property) or even 20-25% (co-op or condop), plus you should budget 2-5% of the purchase price for closing costs. Buying in a co-op? The barrier to entry is even higher, as you need two years of post-closing liquidity as well. Confused? Overwhelmed? Remember that you only have to save for the down payment one time — your first home purchase — and check out the links below Related posts:

Who do I need to work with to buy an apartment?

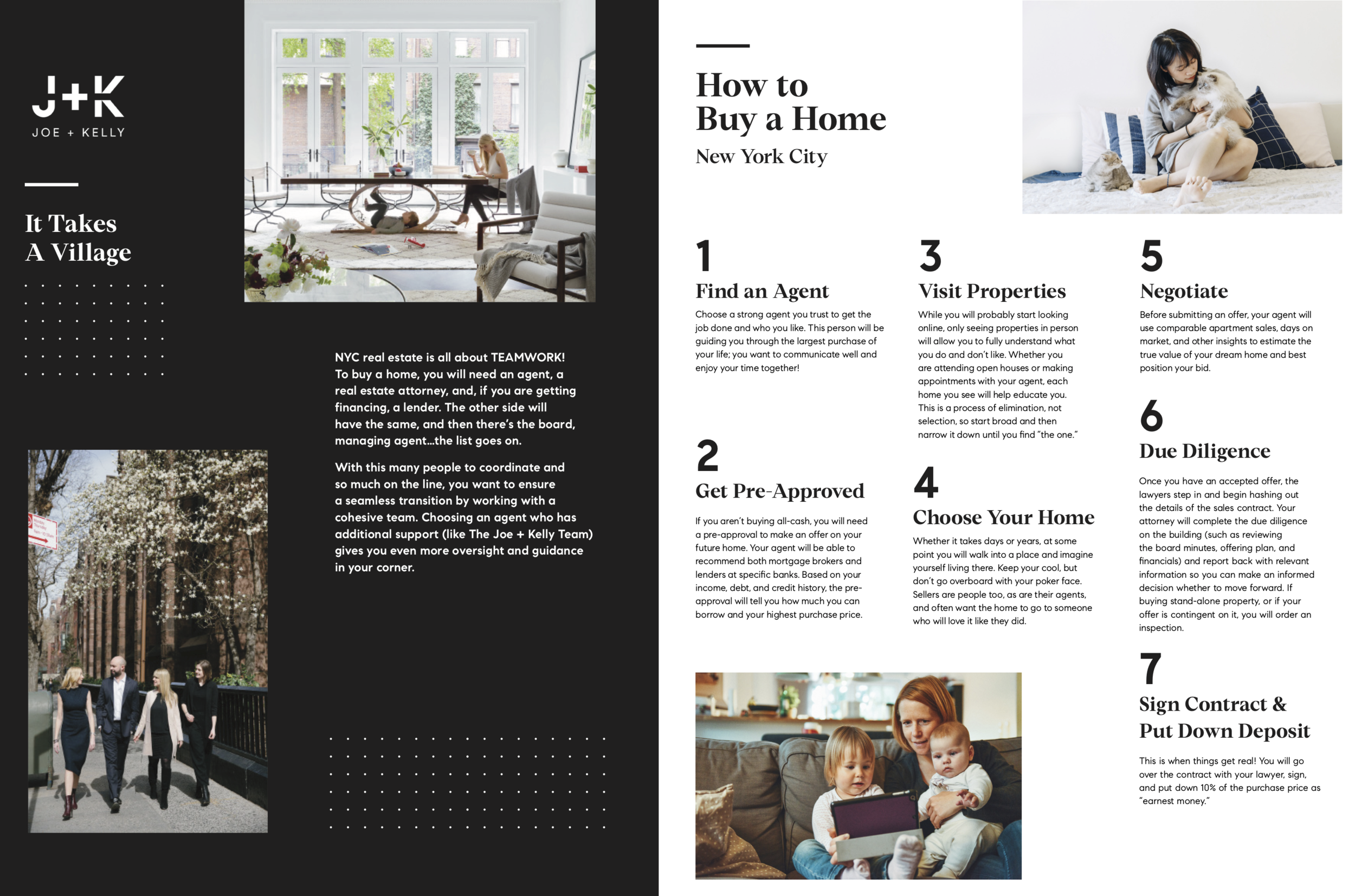

It takes a village to get you a home. Another reason to work with a (strong) agent is that they act as quarterback during the deal, organizing the moving parts and guiding everyone else involved. If you are getting financing, you will need a mortgage provider, and either way you need a real estate attorney. What does everyone do, and how should you decide who to hire? Read the posts below for a breakdown, and come to my spring event, The Rent Is Too D*mn High! to learn even more. Related posts:

All Posts about Buying:

Did that get your attention? It should. Because it ties into a lot of things I harp on, and my goal in this industry: protecting people from misinformation and advising them to the best of my ability. And what I HATE about Zillow is that the company tells people not to trust agents, not to work with agents, and to purchase homes solo. But the reason for this is not to protect buyers; it’s that Zillow NEEDS unrepresented buyers, because it sells these buyers.

In NYC Zillow goes by a different name: StreetEasy. StreetEasy originally started to make the rental process more transparent, but after being purchased by Zillow really went the opposite direction and began intentionally misleading consumers.

No, they aren’t adding a tax on your metrocard purchase. They are increasing the taxes involved in high-value real estate transactions and, allegedly, using the proceeds to fix my favorite broken train system. I’m always skeptical that money will go where it’s supposed to but if this does happen, it will make me feel a bit better about why the tax exists.

While I can’t give in depth financial info related to taxes and which countries have imposed limits on taking cash abroad (China comes to mind), I can break down how this is similar and different from the process for those US-based, and which property types are usually best in which circumstances.

If the broker is the QB…ok I don’t actually know football well enough to make intelligent analogies about who represents what. But we will start with someone who is necessary in 100% of NYC transactions, even if you (foolishly) choose not to work with an agent.